IHS: Asia driving strong global demand for polyethylene

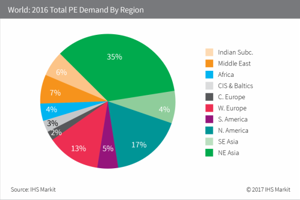

HOUSTON – Led by China and India, rising middle class consumers in Asia and elsewhere are driving increasing global demand for polyethylene, a key plastic, according to new research from IHS Markit. The world’s most used plastic, PE is essential for the production of numerous materials ranging from film for packaging and grocery bags, to detergent bottles and pipe for construction.

Entering 2017, current global demand for PE is 92 MMt, but according to the IHS Markit report entitled IHS Chemical: 2017 Polyethylene World Analysis, PE demand growth will increase 21 MMt by 2021, to 113 MMt. That translates to an average annual growth rate of 4.2% or 1.4 times GDP during 2016 to 2021, according to IHS Markit.

“The global polyethylene market is experiencing very strong growth and that’s for good reason, since, in terms of global plastic demand, there is nothing bigger than PE when it comes to packaging materials,” said Joel Morales, senior director, polyolefins Americas at IHS Markit, and one of the authors of the PE report. “PE is a very versatile, durable material—it is the workhorse of the plastics industry, and the world’s largest volume plastic.”

PE is the material of choice, Morales said, for both food and consumer packaging around the world, and as more and more people see incomes rising globally, they become consumers of more goods that are made of plastic or wrapped in plastic film. Film and sheet applications, which is key to the packaging sector, is the most important plastics use segment globally, according to the IHS Markit report, representing more than 60% of plastics demand.

A comparison of per-capita consumptions for particular regions or countries best illustrates growth opportunities in the PE business, Morales said. In 2016, IHS Markit estimated the average per-capita PE consumption worldwide was 12 kg per person, which obscures a broad range from less than 1 kg per person in many developing countries to as much as 40 kg per person in developed countries, particularly those that also have significant export positions in semi-finished or finished goods.

“Therefore, countries with large populations and rapidly expanding economies, such as China, India and Indonesia, have tremendous future growth potential,” Morales said. “India currently consumes about 4 kilograms of PE for person, and we expect that to increase significantly during the next 25 years to 13 kilograms per person. As a result, IHS Markit expects India to add more than 18 MMT in PE demand by 2041, based on population growth. When you assess similar growth charts for China, Indonesia and other regions like Africa and Latin America, the demand growth is significant, and producers are investing now for that growth.”

Additionally, with increased economic growth comes infrastructure development, and in terms of construction, plastic pipe is increasingly, competing against steel and concrete for more uses, ranging from water transmission to natural gas transmission.

Morales said the PE market is strong and relatively tight, and that is an advantage to producers, at least for now. “Producers in all regions are enjoying nearly historic high margins, but in the coming years, as new capacity expansions come online, we will see those margins begin to erode with some advantage shifting back to consumers,” Morales said.

The market is tight due to strong global demand with corresponding, historically high global operating rates, according to Morales, which at 87% currently, are the highest since 2007. The IHS Markit research indicates operating rates will bottom-out at around 84% in 2018, due to all the new capacity coming online.

Despite the challenging global economic conditions, PE producers in North America and the Middle East continue to benefit from their advantaged ethane feedstock cost position. Based on their competitive positions, IHS Markit said that both Middle Eastern, and later in the forecast period, North American, producers will benefit from rising export volumes, which will create significant global trade shifts for the industry.

Driven by the availability of ample supplies of affordable shale gas as feedstock, the first wave of a tremendous amount of US shale driven PE expansion projects are coming online now through 2018, and are rapidly expanding global PE capacity. According to IHS Markit, more than 12 MMT of PE will come online in North America by 2026. Dow Chemical, ChevronPhillips, Equistar (LyondellBasell), ExxonMobil, Formosa, INEOS Sasol, Nova, PTTGC and Shell all have major projects coming online during the next five years.

Exxon Mobil alone has announced major PE expansions at its Beaumont, Texas, and Mont Belvieu, Texas, facilities that together exceed more than 2 MMT of PE additions. ChevronPhillips Chemical is adding 1 MMT in new PE capacity in 2017, while Dow Chemical plans to add 900,000 mt of PE capacity in 2017.

China leads Northeast Asia in consumption demand for PE, with domestic consumption expected to increase nearly 10 MMt by 2021, which accounts for a little more than half of the entire global demand expansion during the study period. China drives 97% of PE demand growth in the region.

Comments