Insight: How sanctions made a showpiece Chinese refinery's Western partners run for the exits

- Yulong refinery ramps up Russia oil buying after sanctions hit

- Refiner is top Chinese buyer by site of seaborne Russian crude

- Widening Western sanctions drive bifurcation of global oil trade

- Yulong overseas customers, banks, service providers cut access

- Global oil firms cut sales to Yulong after sanctions

When Shandong Yulong Petrochemical opened its Singapore office a year ago, the company staged a lion dance to herald prosperity for the new $20-B oil refiner at the center of modernization efforts in its home province in China.

But Yulong's ambition to rub shoulders with global heavyweights, backed by Beijing's push to modernize its refiners, was upended on October 15, when the UK sanctioned it for dealing in Russian oil. The European Union followed suit a week later. Neither the EU nor the UK said Yulong violated sanction-related price caps.

The effect was immediate: Yulong's non-Russian suppliers, foreign customers, banks and vendors ran for the exits, reporting shows, leaving it with little option but to buy even more Russian oil, a consequence of widening Western measures to curb Moscow's oil revenue as its Ukraine war continues.

Going after Yulong marked an escalation in Western efforts to disrupt Russia's oil flows. Previously, Western black-listings of Chinese firms focused mainly on smaller operators, often for violating U.S. prohibitions against importing Iranian oil.

Media is reporting for the first time the extent of the disruption to Yulong's operations caused by sanctions, which have taken some of the shine off China's newest refinery project, limited its crude sourcing and forced it to turn inward.

"These designations are part of a developing trend in the UK and EU’s approach to sanctions; namely to target third-country actors that are perceived to be acting contrary to EU and UK foreign policy objectives," said Alexander Brandt, sanctions partner at law firm Reed Smith. "Such measures are increasingly akin to aspects of U.S. secondary sanctions," he said.

The growing ranks of sanctioned participants in China and around the world have been forced to deal with an expanding network of producers, refiners, middlemen and the "shadow fleet" ships on the blacklisted side of a bifurcated global oil industry.

Within days of the UK censure, Yulong's mainstream crude suppliers - including bp, TotalEnergies, Saudi Aramco, PetroChina and Trafigura - cancelled shipments, afraid of incurring secondary sanctions.

(click image to enlarge)

In Yulong's Singapore office, where a team of around 10 is led by an ex-Chinese state oil executive, staffers lost access to service providers including trading platform Intercontinental Exchange, information provider LSEG and at least one European brokerage, people familiar with the matter said.

"Nobody seemed to have a contingency plan in place," one of the trading sources said, declining to be identified given the sensitivity of the matter.

Yulong's Singapore office, the main contractual party for its global supplies, lost services from banks in the city-state, two sources said. Yulong's banks in Singapore included local branches of Agricultural Bank of China and Bank of China as well as UOB and OCBC, according to the Accounting and Corporate Regulatory Authority.

"OCBC Group has always complied strictly with our robust sanctions policy as well as the laws and regulations in all the jurisdictions the group operates in," an OCBC spokesperson said.

Yulong's export customers also got cold feet: regular buyers including global traders Vitol and Gunvor suspended purchases of petrochemicals like methyl tert-butyl ether and toluene beyond a November 13 grace period, two people familiar with the matter said.

China's Wanhua Chemicals, which has several Western clients, also halted benzene purchases, three sources said.

India-based refiner Nayara, which is Russian-owned, was also cut off by many of its counterparties when the EU sanctioned it over Russian oil purchases in July. Since then, it has been importing crude from Russia exclusively.

Rajesh Chopra, an analyst with energy consultancy XAnalysts, said stepped-up Russian crude buying by sanctioned refiners is an unintended consequence.

"These sanctions are proving ... kind of counterproductive because instead of stopping the Russian crude processing in those complexes, it's not giving the sanctioned refiners any other option but to process more Russian crude," he said.

On the day that the UK sanctions were unveiled, one panicked supplier told Yulong it wanted to cancel a fully paid 2-MMbbl Middle Eastern oil shipment worth around $130 MM that was about to discharge at Shandong's Yantai port, a person briefed by Yulong said. The cargo was later delivered within a grace period.

Over several days, Yulong's suppliers cancelled at least half a dozen shipments.

Top Russian buyer. To plug the gap left by mainstream suppliers, Yulong snapped up 15 cargoes of Russian oil for November, roughly doubling its typical monthly intake, traders said. Yulong added more than 10 Russian cargoes for December delivery, traders said.

Yulong opened its 400,000-bpd refinery last year and lined up supplies from Oman, the United Arab Emirates, Canada and Russia.

Yulong's Russian shipments accounted for 40% to 50% of its crude purchases before the sanctions hit, according to three traders and two analysts, making the refinery Moscow's single-largest Chinese client. At present, Russian oil accounts for most if not all of its imports, multiple traders said.

Russian oil seemed like a safe bet given that Moscow is a longtime supplier to China, including its state-run oil giants, and its trade is not prohibited if it complies with a Western-imposed price cap.

In sanctioning Yulong, the UK and EU cited its dealing in Russian oil, benefiting Moscow, but did not mention the price cap. Beijing, which has close ties with Moscow, has rejected unilateral sanctions and criticized Yulong's blacklisting.

Russian oil - mainly the ESPO blend, Russia's flagship grade for Asian markets, which is typically cheaper than Middle Eastern equivalents and takes less than a week to ship from Russia's Far East - is a favorite of refiners in China's Shandong province.

With few alternatives, traders said they expect Yulong to rely even more on Russian oil, which at a current discount of over $5 versus the Middle Eastern benchmark, will bolster the loss-making firm's margins.

"Overall, it's a blessing in disguise," said a Chinese executive who deals in Russian oil. "With cheaper, abundant Russian oil, Yulong could fly high and fly free."

Yulong: Past, present and future. The Yulong project was greenlit by Beijing as part of a push to create stronger industrial firms with international standing while consolidating and modernizing Shandong's crowded refining sector, where some smaller independent operators dubbed "teapots" have been known to evade taxes and flout government limits on crude imports.

In 2023, talks began with Saudi Aramco to take a 10% stake in Yulong, along with a long-term supply deal.

Yulong was founded by private aluminum smelter Nanshan Group, but state-controlled Shandong Energy Group is its second-biggest shareholder.

That has allowed Yulong to operate in some ways like a state company, according to five sources familiar with Yulong, which has meant avoiding cheap Iranian and Venezuelan oil favored by teapots for fear of exposure to secondary U.S. penalties.

Market participants expect Yulong to find workarounds to Western restrictions.

It is already diverting more petrochemical output to the domestic market after export clients stopped buying, enabling it to limit declines in refinery runs, over 10 traders said. A downstream unit that Yulong is set to bring online next year could absorb even more production.

Yulong could segregate some of its business in a separate corporate entity, industry sources said, a structure adopted by U.S.-sanctioned refiners Shouguang Luqing and Shengxing Chemical, with the intention of allowing counterparties to deal with non-sanctioned entities.

Yulong, whose November purchases of Russian oil will cost it roughly $660 MM based on market prices, must also find new financing channels and may rely more on Chinese non-bank credit providers, three traders said.

Xiamen Xiangyu Group, a government-backed trader, is expected to continue financing Yulong's purchases, two sources close to Xiangyu said. As a middleman, Xiangyu typically pays on behalf of Yulong for Russian cargoes, becomes the owner of the oil on paper and allows the refiner 30 days to repay with interest. Xiangyu did not respond to a request for comment.

Yulong could also seek credit from its suppliers of Russian oil now that it is an even bigger client, said the Chinese executive who deals in Russian oil.

($1 = 7.1230 Chinese yuan renminbi)

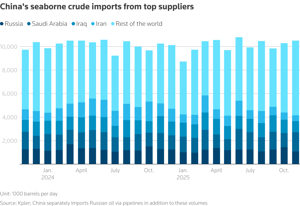

China's crude seaborne imports from top suppliers https://reut.rs/48e89ZW

Comments