Key U.S. energy data trends to track as tariffs kick in

Energy product traders, utilities, investors and business executives are among those scrambling to assess the likely impact of new steep tariffs on the United States' largest trade partners, which kicked in on Tuesday.

New 25% tariffs on imports from Mexico and Canada, along with a doubling of duties on Chinese goods to 20%, took effect on March 4, kicking off a trade war that will have far-reaching effects on governments, businesses and households alike.

Retaliatory moves from China and Canada have already been announced, while details on Mexico's planned responses are expected in the coming days.

Further reprisals from impacted countries are possible in the coming weeks as business lobbies and trade advisers weigh in on measures that target pain points for the U.S. economy.

Among the sectors likely to be targeted in any upcoming counter moves is the mammoth U.S. energy sector, which is the top producer of both crude oil and natural gas and is a major importer of power system and energy extraction components.

Below are key energy sector trends and data points that are likely to be impacted by the latest trade war.

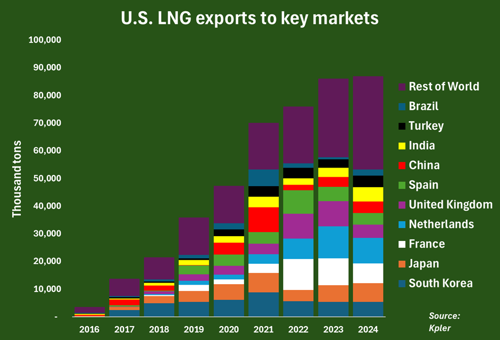

Oil and gas. As the world's top exporter of liquefied natural gas (LNG) and third largest exporter of crude oil in 2024 - according to Kpler - the U.S. is at risk of facing retaliatory tariffs on its energy product shipments.

Buyers of LNG, crude oil and refined fuels can quite easily find other suppliers of the same commodities, and so can avert critical supply shortages while depriving the U.S. of a major source of export earnings.

At the same time, U.S. exporters may face difficulties in quickly finding replacement markets for their goods, given the weak global demand growth for fossil fuels so far in 2025.

In 2024, the top buyers of U.S. crude oil were the Netherlands, South Korea, China, the United Kingdom and Canada, while the top buyers of U.S. refined products were Mexico, Chile, Brazil and Peru, Kpler data shows.

That means three of the largest markets for U.S. crude and fuels are now saddled with stiff tariffs on the goods they ship to the U.S., and are likely looking for items they can target in return.

China and Canada accounted for around 13% of total U.S. crude exports in 2024, while Mexico accounted for 24% of U.S. clean product exports, Kpler data shows.

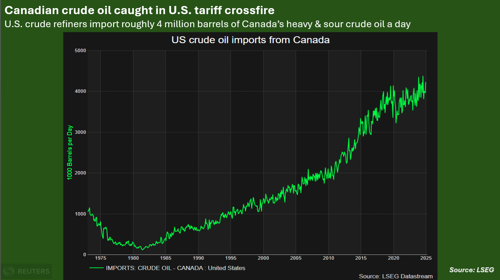

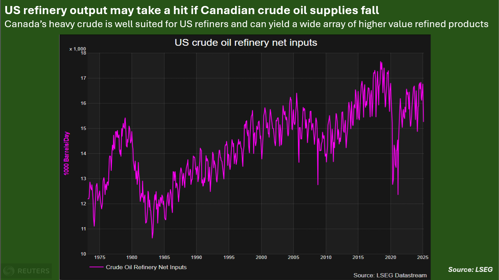

Canada is also a major supplier of crude oil to the U.S., and the new 10% tariff on Canadian energy imports stands to impact U.S. refinery margins and boost U.S. gasoline prices.

Reduced Canadian oil supplies could also impact U.S. refinery production levels, and eat into overall U.S. refined product output.

In LNG, U.S. export flows have been primarily directed towards Europe, and only China ranked among major buyers of U.S. LNG shipments last year (with a 5% share) among the countries facing new tariffs.

That said, the U.S.' heavy European exposure in LNG trade leaves it vulnerable to potential backlash by European buyers should Europe be next in line for tariff treatment by the Trump administration.

U.S. natural gas producers also sell large volumes to Mexico via pipelines, which again could be impacted by any worsening in trade tensions between the countries.

Power impact. The U.S. is a major importer of several components tied to the energy extraction, power production and electricity distribution sectors.

The U.S. wind power industry is a top buyer of parts and components made in Canada, China or Mexico, and so could face sharply higher import costs going forward.

U.S. utilities are also the world's largest importers of grid-scale battery systems and transformers that are made mainly in China, South Korea and Japan, and so again potentially face stiff price increases for critical equipment.

On the flip side, Canada and Mexico were among the top markets for U.S.-made gas turbines in recent years, and so U.S. producers of those turbines may now get hit by reduced sales to those key markets.

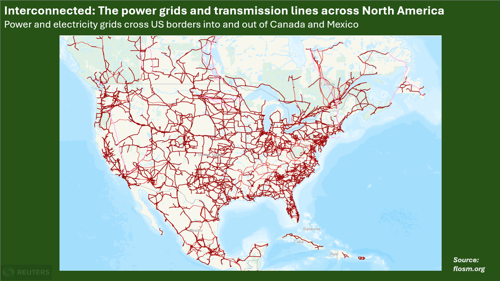

Power consumers could also be hit by trade tariff fallout, as Canada supplies several parts of the northern United States with clean power, which could feasibly be impacted by any further souring in trade relations with Canada.

Any cuts to Canadian power flows to the U.S. could place added strain on the domestic U.S. grid, and force utilities to raise production from natural gas and coal-fired power plants.

Higher fossil fuel generation could in turn boost emissions around the country and further elevate local natural gas prices which have already climbed by around 18% so far this year.

The opinions expressed here are those of Gavin Maguire, a market analyst for Reuters.

Comments