Opinion: bp’s green failure offers Big Oil a lesson in moderation

- Share price underperformed peers

- Revenues from renewables sector complicated by costs and technical problems

- Elliott Management stake increased the pressure for strategy change

- Renewable energy set to grow faster than fossil fuels

bp has returned to its oil and gas roots in a spectacular about-turn following its trailblazing attempt five years ago to become a renewables giant. The takeaway for Big Oil is that the energy transition is a marathon, not a sprint.

bp CEO Murray Auchincloss on Wednesday unveiled a long-awaited strategy reset, abandoning his predecessor Bernard Looney's eye-catching 2020 plan to "re-invent" the company.

The 54-year-old Canadian now aims to increase oil and gas production by up to 2.5 MMbpd of oil equivalent by 2030, from 2.36 MMbpd in 2024. He also cut spending on low-carbon energy, ditched a target to sharply grow renewables generation capacity and removed a goal of reducing overall emissions by 2030.

That's quite a shift for a company that had been a poster child for Big Oil's efforts to decarbonize rapidly. bp invested billions globally in large offshore wind, solar, hydrogen and low-carbon projects. But inflation, technical problems and soaring energy prices undermined the plans.

As a result, bp had to book billions of dollars in impairments, debt rose and its stock underperformed. It has spun off its offshore wind business and plans to sell half of its solar business while mothballing hydrogen projects.

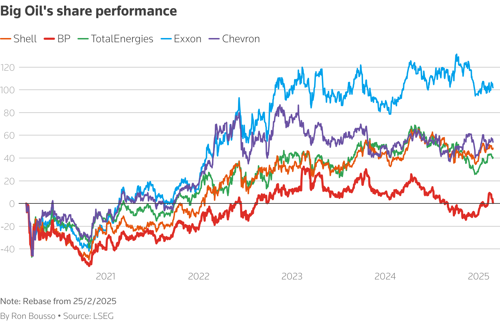

The British company's share price remained roughly flat over the last five years, while Exxon Mobil’s and Chevron’s rose by 102% and 55%, respectively.

The growing financial distress and loss of corporate direction have raised speculation that bp will be bought by a rival. Activist shareholder Elliott Management has meanwhile acquired a large stake, adding to the pressure for a radical revision of strategy.

Failure to launch. What a difference five years make.

bp's energy transition strategy was met with strong investor support in 2020, when the COVID-19 pandemic reinforced the idea that the world was changing and energy prices sank because lockdowns destroyed demand.

The environmental agenda had gained prominence in financial markets, leading to a rise in ESG funds as well as net-zero commitments from banks, funds and businesses.

Governments, particularly in the West, unveiled ambitious plans to decarbonize their economies through support for renewables.

The mood changed swiftly as the world emerged from the pandemic into an era of elevated inflation in 2022, exacerbated by Russia's invasion of Ukraine. The war disrupted oil and gas supplies and sent prices soaring, creating record profits for fossil fuel producers.

Two sectors in particular - offshore wind and hydrogen - illustrate the predicament Big Oil found itself in.

bp and its European peers said their extensive offshore experience would give them a competitive edge in wind versus rivals such as utilities. Companies piled into projects, offering governments lucrative terms to construct multi-billion offshore wind farms, including in Britain, Germany, South Korea, Taiwan and the United States.

Instead, technical problems, inflation and supply chain delays made many projects financially unviable. U.S. President Donald Trump's animosity towards offshore wind has compounded the problem.

Low or zero-carbon hydrogen – lauded as a panacea that could decarbonize transportation, home heating and industry – was also considered an area of natural growth for fossil fuel producers. But the buzz has today mostly evaporated due to its high production and transportation costs.

What’s next? bp is not the only energy company to complete a green volte-face.

In recent months, other European oil giants including Shell and Norway's Equinor have sharply slowed their energy transition plans, cutting spending on wind, solar, hydrogen and other low-carbon projects.

But this reversal – which means investing billions in new oil and gas projects at a time of high commodity prices and elevated service costs – is not without risks.

Oil demand growth appears to be slowing, as gasoline consumption plateaus in China and the United States, the world's biggest oil consumers. And with abundant global supply, the long-term outlook for crude prices is most likely on a downward slope.

The outlook for natural gas is better, but likely weaker than Big Oil companies imagine. Gas markets also face abundant global supply as well as competition from coal and improved renewables technologies. A wave of liquefied natural gas (LNG) production set to hit the market over the next five years could add to downward pressure on prices.

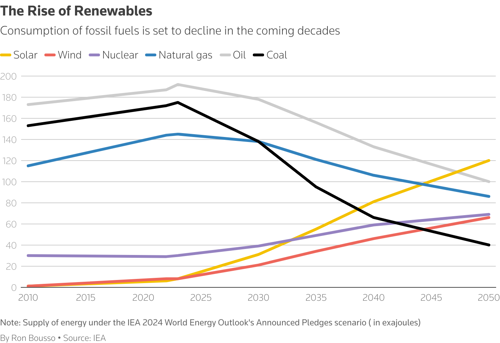

Meanwhile, renewables remain the fastest-growing source of energy. The International Energy Agency forecasts renewable energy capacity to nearly triple between 2023 and 2030 to nearly 11 MM gigawatts (GW).

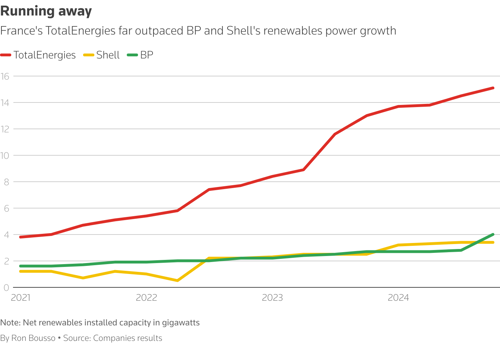

And some companies have shown that it is possible to forge a more sustainable, moderate transition path. French energy giant TotalEnergies has invested steadily since 2020 in oil, gas and renewables, growing a significant power generation business that is already generating profits.

While bp and its rivals may be able to temporarily walk back from their green goals, they will not be able to sidestep the energy transition for long. Investors will expect these companies to offer viable long-term strategies, because while bp is facing an existential crisis, the energy transition is not.

The opinions expressed here are those of Ron Buosso, a columnist for Reuters.

Comments