China's surplus crude oil hits nearly 1 MMbpd for September

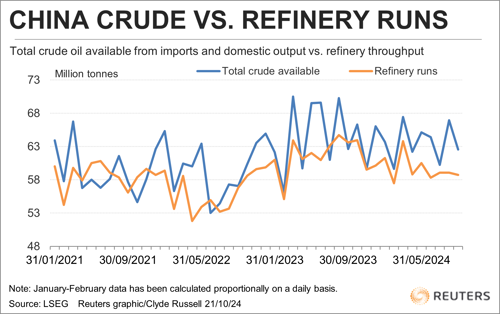

The weak position of China's crude oil sector was underlined by September data showing a sixth consecutive monthly drop in refinery processing, leading to nearly 1 MMbpd of oil being available for storage.

China's refineries processed 14.29 MMbpd of crude in September, up slightly from 13.91 MMbpd in August, but down 5.4% from the same month in 2023, according to official data released on Friday.

The softness in refinery throughput followed earlier data showing crude imports fell 0.6% in September from a year earlier, slipping to 11.07 MMbpd, the fifth straight month that imports were less than in 2023.

The frailty of China's oil sector meant that the ongoing pattern of this year of significant volumes of surplus crude were available to be added to either commercial or strategic storages.

China, the world's biggest crude importer, doesn't disclose the volumes of oil flowing into or out of strategic and commercial stockpiles, but an estimate can be made by deducting the amount of crude processed from the total of crude available from imports and domestic output.

Domestic production in September was 4.15 MMbpd, up 1.1% from the same month last year, according to data from the National Bureau of Statistics.

Putting domestic output together with imports gives a combined total of 15.22 MMbpd available for processing. Refinery throughput was 14.29 MMbpd, leaving a surplus of 930,000 bpd.

For the first nine months of the year the total volume of crude available was 15.25 MMbpd, while refinery throughput was 14.15 MMbpd, leaving a surplus of 1.1 MMbpd.

It's worth noting that not all of this surplus crude has likely been added to storages, with some being processed in plants not captured by the official data.

But this will only be a relatively small volume, meaning that overall China has been importing crude at a far higher rate than it needs to meet its domestic requirements.

The question for the market is why Chinese refiners have continued to import more crude than they actually require?

Price moves. The answer is most likely to be found in price movements, with the recent pattern being that China imports more crude when refiners believe prices are low, while arrivals are trimmed when they view prices as too high, or as rising too quickly.

It's worth noting that in September last year Chinese refiners were actually drawing on inventories, processing 15.48 MMbpd against available crude 15.24 MMbpd, resulting in a deficit of 240,000 bpd.

At the time this was happening, crude prices were surging, with Brent futures rising from $73.39 per bbl at the end of June to a high of $97.06 by the end of September last year.

However, this year has seen a different pattern in crude prices, with Brent trending weaker since its high so far in 2024 of $92.18 per bbl on April 12, to a low of $68.68 by Sept. 10.

The price has since recovered to around $73.16 per bbl in early Asian trade on Monday, but at this level it's probably likely that Chinese refiners deem prices reasonable.

It's also the case that China's refiners are looking to build a cushion of inventories just in case the tensions in the Middle East escalate to the point where there is an actual disruption of crude shipments, or a sustained threat that keeps a risk premium in the price.

However, there is little doubt that China's oil sector is weak, and would look considerably more so if refiners weren't buying crude surplus to their needs.

The data also makes even the lower forecasts for China's demand growth made by OPEC look wildly optimistic, with the producer group estimating demand will rise by 580,000 bpd this year, even though imports are down 350,000 bpd for the first nine months of the year.

Comments