Tsubame BHB receives order for 2nd unit in Japan, installing small ammonia manufacturing facilities for industrial use

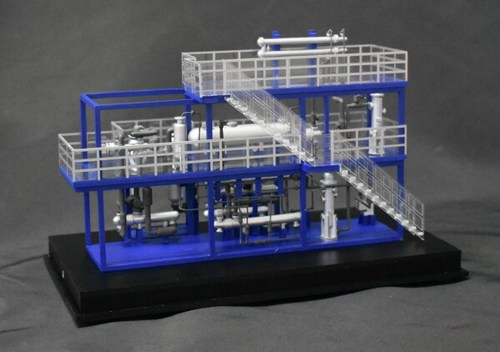

Tsubame BHB Co. Ltd., which is aiming for the social implementation and commercialization of ammonia manufacturing plants that can synthesize ammonia at low temperatures and low pressures, has received an order for small ammonia synthesizing facilities, the second commercial unit in Japan for industrial applications.

In recent years, an increasing number of ammonia production plants in Japan are shutting down, and with rapidly increasing import prices, there has been a growing concern regarding the ammonia supply chain. Onsite ammonia production facilities that utilize Tsubame BHB's electride catalyst technologies resolve these issues, achieving stable ammonia supply.

The small ammonia synthesis facilities recently ordered have an annual production capacity of 500 tons (tpy). Tsubame BHB will supply the small ammonia manufacturing facilities, as well as the ammonia synthesis catalysts. The customer is also considering future expansion of these small ammonia manufacturing facilities.

The customer verified introduction of Tsubame BHB's technologies from 2022. Basic design began in January 2024, and detailed design began in August 2024. Startup of ammonia production is scheduled for around the summer of 2026

Approximately 80% of the ammonia used worldwide is used in fertilizers, and the remaining 20% is used in industrial applications. Ammonia applications in Japan focus mainly on industrial uses such as raw material for chemicals or denitrification at thermal power plants. About 80% of the roughly 1 MMt consumed annually is produced domestically, and the other 20% is imported.

Since 2000, ammonia production plants in Japan have been suspending operations; there are currently four ammonia production companies in Japan, and ammonia production volumes have declined from 2 MMt in 2000 to around 1 MMt in 2022.

Furthermore, one of the manufacturers with the highest ammonia production volumes has expressed its intent to suspend domestic production of ammonia by 2030, so domestic production will be handled by the remaining three companies.

There are also concerns about the supply of ammonia from Russia, the world's second-largest ammonia producer, due to the effects of the war with Ukraine, and amid the various supply related problems arising in the main user countries, the price of imports into Japan is increasing dramatically. In this backdrop, companies around the world with a need for ammonia have deep concerns about procurement moving forward.

Comments