Diesel consumption falls in China due to reduced economic activity and fuel substitution

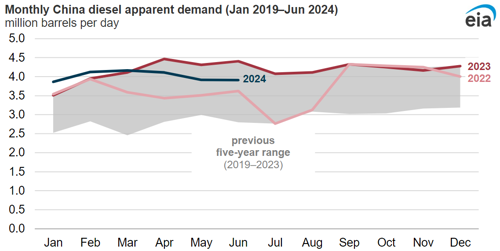

The U.S. EIA estimates that diesel consumption in China totaled 3.9 MMbpd in June 2024, a decline of 11% from the same month last year and the largest year-over-year decline in consumption for any month since July 2021.

From 2020 to 2022, China’s government, businesses, and communities used social distancing and stay-at-home orders as the primary method to prevent the spread of COVID-19, which regularly disrupted travel and caused fluctuations in diesel consumption. After establishing another all-time high in 2023, diesel consumption began declining in the second quarter of 2024. We attribute the recent decline in diesel consumption to two major factors—slowing economic activity, mostly because of a slowdown in building and housing construction, and the substitution of liquefied natural gas (LNG) for petroleum diesel fuel in heavy-duty trucks.

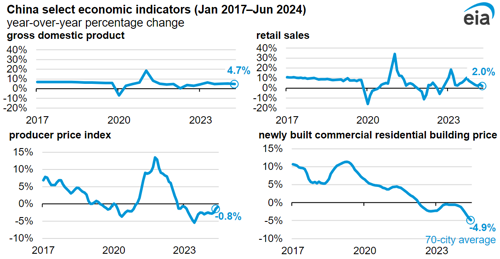

China’s GDP grew 4.7% from last year in the second quarter of 2024, a bit less than the government target of 5%. Although faster than most growth rates in developed economies in OECD countries, this GDP growth rate is several percentage points slower than China’s growth rate in the years before the pandemic. Consumption and investment indicators partially explain the slower growth rate. Although volatile around the pandemic years, changes in retail sales, housing prices, and producer prices in China all show slowing or declining activity in 2024. Slowdowns in trucking activity and construction correlate with reductions in China’s diesel consumption because diesel consumption is linked with these economic activities.

Aside from less use of diesel because of slowing economic activity in the construction and property sectors, a small but growing share of China’s trucking fleet is using LNG instead of diesel for fuel. According to data and analysis from BloombergNEF, LNG truck sales have made up around 20% of total truck sales from the third quarter of 2023 through March 2024. Although still small relative to the total truck fleet in China, the growing market share of LNG trucks is displacing some diesel consumption in the country.

China’s National Bureau of Statistics and General Administration of Customs publishes monthly data on crude oil refinery processing, refined petroleum product output, crude oil and petroleum product imports, and crude oil and petroleum product exports. The agencies do not publish inventory levels or stock changes. Because of this exclusion, we calculate China’s apparent demand of diesel as refinery production of diesel plus imports minus exports. This calculation is different from product supplied, our proxy for consumption in the United States, which accounts for stock changes. Despite lacking inventory data, China’s monthly petroleum statistics can serve as a useful guide for general trends in the country’s petroleum market.

We slightly reduced our forecast petroleum consumption growth in China in our August Short-Term Energy Outlook. We forecast China’s petroleum and liquid fuels consumption will grow by about 300,000 bpd in 2024 and in 2025. Our forecast growth rate is slower than the 2015–19 average annual growth rate of 500,000 bpd.

Related News

- Honeywell collaborates with SAF One and Tata Projects to enable sustainable aviation fuel production

- GIZ and thyssenkrupp nucera partner to advance green hydrogen and power-to-X markets in India

- Technip Energies awarded two large contracts by BPCL for new units at Bina and Mumbai refineries in India

Comments