China's LNG imports set to slow

China appears to have taken advantage of low prices in the spot market so far in 2024 to boost the amount of gas in storage, absorbing some of the extra fuel that would otherwise have been sent to Europe.

But as storage facilities fill and spot prices rise, the intake is likely to taper over the summer, redirecting more liquefied natural gas (LNG) cargoes to Europe and accelerating the fill rate at the other end of Eurasia.

To the frustration of foreign analysts, China does not publish statistics on gas, oil or coal inventories, which are considered commercially sensitive and a matter of national security.

But the country consumed a record 55 metric MMt of gas from overland pipelines and sea-borne LNG in the first five months of 2024, according to data from the General Administration of Customs.

The intake rose from 47 metric MMt in the first five months of 2023 and 46 metric MMt in the same period of 2022, when Russia’s invasion of Ukraine sent spot gas prices soaring. It comfortably exceeded the pre-invasion record of 50 metric MMt set in the first five months of 2021.

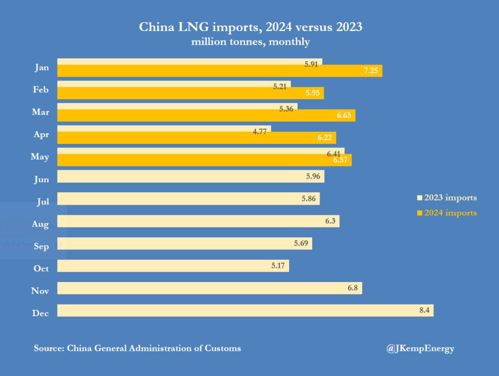

LNG imports ran above prior-year levels every month between January and May, and pipeline imports were also above prior-year levels in every month except April.

At the same time, domestic production surged to a record 76 metric MMt in the first five months of 2024 from 72 metric MMt in 2023, 68 metric MMt in 2022 and 64 metric MMt in 2021.

Output from Sichuan, easily the largest gas-producing province, has doubled since 2016, as the government has prioritized expansion of domestic fields to reduce reliance on imports.

As a result, the total amount of gas available from domestic production and imports hit a record 130 metric MMt in the first five months of 2024, up from 118 metric MMt in 2023 and 114 metric MMt in 2021.

China continues to connect more urban households to the gas network to reduce coal burning and improve air quality. But the enormous increase in the amount consumed so far this year far outstrips additional demand from households and industry.

Much of the extra imported gas has likely been used to top up domestic storage after inventories were allowed to deplete in 2023 and 2022.

Active management. China has a long tradition of actively using government-run inventories to stabilize commodity prices, which has been seen as a core function of the state.

In imperial China, the government’s “ever-normal granaries” purchased surplus grain when supplies were plentiful and sold when supplies were low to stabilize prices at a moderate level.

In recent years, the same active approach has been extended to oil, copper, aluminum and other commodities. Now there are signs it is being applied to gas via changes in LNG imports.

China’s importers have contracted large volumes of LNG from Qatar, Australia, Malaysia and a host of other smaller exporters, but in some cases, they have been able to insist on flexibility to resell to third countries.

The result is that China can adjust LNG imports and inventories in response to changes in spot market prices.

In 2022/23, flexibility was employed to trim LNG imports and run down inventories in response to surging spot market prices. In 2024, the flexibility has been employed in reverse to take in more cheap gas and refill storage.

But spot market prices for gas delivered to Northeast Asia have climbed to an average of more than $12 per million British thermal units (Btu) so far in June, up from less than $9 in February and March.

Prices are no longer especially cheap compared with prior years. China is likely to reduce discretionary purchases and slow the rate of inventory accumulation.

As it backs away from the spot market, more LNG will be sent to Europe as well as price-sensitive customers in south and southeast Asia.

(John Kemp is a Reuters market analyst.)

Comments