China continues to lift crude oil stockpiling amid weak refinery runs

LAUNCESTON, Australia (Reuters)— The world's biggest crude importer has had a soft start to the year. China added more than 1 MMbpd of crude oil to stockpiles in May as soft imports were outweighed by even weaker refinery processing volumes.

A total of 1.08 MMbpd were added to China's commercial or strategic inventories in May, up from 830,000 bpd in April, according to calculations based on official data.

Over the first five months of 2024, China boosted stockpiles by 790,000 bpd from the same period in 2023, and the pace of inventory builds is accelerating, rising from 700,000 bpd in the first four months of the year.

The surge in crude flowing into storage, coupled with a decline in oil imports in the first five months of the year, undermines expectations that China's crude demand will grow strongly in 2024.

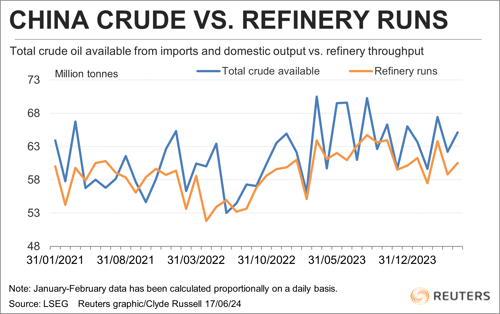

China doesn't disclose the volumes of crude flowing into or out of strategic and commercial stockpiles, but an estimate can be made by deducting the amount of crude processed from the total of crude available from imports and domestic output.

The total crude available to refiners in May was 15.33 MMbpd, consisting of imports of 11.06 MMbpd and domestic output of 4.27 MMbpd. The volume of crude processed by refiners was 14.25 MMbpd, leaving a surplus of 1.08 MMbpd to be added to storage tanks.

Refinery throughput dropped from 14.30 MMbpd in April and from 14.60 MMbpd in May last year. May was also the second consecutive month that refinery processing declined from the same month a year earlier.

For the first five months of the year refineries processed 301.77 metric MMt, according to data released on Monday by the National Bureau of Statistics, up 0.3% from the same period in 2023.

However, converting the refinery processing to bpd shows a rate of 14.49 MMbpd in the January to May period, which is actually down from the 14.54 MMbpd in the same period last year, which was one day shorter because of the leap year in 2024.

Better second half? Crude oil imports were 11.0 MMbpd in the first five months of the year, down 130,000 bpd or 1.2% from the same period in 2023.

Refinery processing has dropped by 50,000 bpd, and 790,000 bpd have been added to inventories.

There are some temporary factors behind some of the weak outcomes, such as several major refineries undergoing scheduled maintenance in May, but it's hard to escape the conclusion that so far this year China's oil demand is falling well short of expectations.

The Organization of the Petroleum Exporting Countries (OPEC) is still forecasting that China will drive global oil demand growth in 2024, accounting for 720,000 bpd of the world total increase of 2.2 MMbpd.

While OPEC's June monthly report does show the producer group is expecting a stronger second half in China, it also shows that the first half is running well behind expectations.

OPEC forecast China's oil demand growth at 570,000 bpd in the second quarter, which would require a surge in June imports, given the soft outcomes in April and May.

While OPEC remains bullish on China's demand, other forecasters are more circumspect, with the International Energy Agency expecting demand growth of around 500,000 bpd in 2024.

Even this more modest forecast will require a strong second half, and will be reliant on China's economy not only gaining momentum, but doing so in areas that boost the consumption of refined products.

This means construction will have to ramp up to boost diesel demand, air travel will have to continue to recover to lift jet fuel sales, and manufacturing will need to strengthen to increase demand for petrochemicals.

A stronger Chinese economy remains likely in the second half, but the question is whether it will be strong enough to allow for the bullish expectations for oil demand to be correct.

The opinions expressed here are those of the author, a columnist for Reuters.

(Editing by Jamie Freed)

Comments