Low U.S. distillate consumption reflects slow economic activity and biofuel substitution

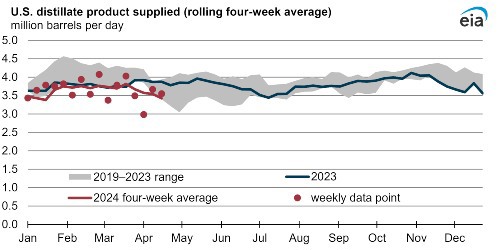

Data source: U.S. Energy Information Administration, Weekly Petroleum Status Report

U.S. distillate consumption so far this year is lower than usual because of warm winter weather, reduced manufacturing activity, and continued substitution of biofuels in place of petroleum distillate on the U.S. West Coast (PADD 5).

As reported in our Weekly Petroleum Status Report (WPSR), four-week average U.S. distillate consumption, which we track using product supplied, has been lower than the previous five-year (2019–23) range for most of 2024 (January 1 through April 19).

Distillate fuel oil includes both the diesel fuel used in vehicles and home heating oil. Changes in product supplied from week to week can be volatile and often reflect natural intermittencies in our survey collection, such as when an import cargo clears U.S. Customs, as opposed to changes in oil supply or demand. However, U.S. distillate fuel consumption has been seasonally low so far this year, suggesting longer-term trends are at play.

U.S. consumers used less heating oil than usual in the first quarter of 2024 (1Q24), part of the warmest winter on record, which we discussed recently in our Winter Fuels Outlook retrospective. Heating oil typically accounts for between 10% and 15% of U.S. distillate fuel consumption in the first quarter of every year, depending on the weather; it accounts for only about 4% the rest of the year. The winter of 2023–24 was 5% warmer than the winter of 2022–23 (measured as heating degree days). We estimate 6% less heating oil was consumed in the United States because of the warmer weather.

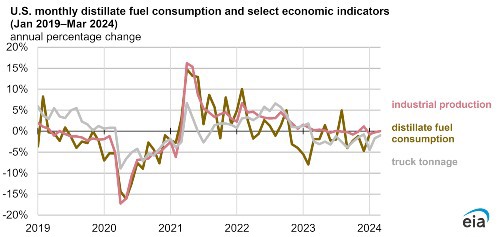

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly; Federal Reserve Bank of St. Louis (FRED); American Trucking Association; Bloomberg L.P.

Economic indicators that correlate with U.S. distillate fuel consumption suggest subdued economic activity. Industrial production—which measures output from manufacturing, mining, and utilities—declined on an annual basis for the second consecutive month in February 2024 and showed no growth in March. The American Trucking Association’s truck tonnage index—which measures domestic freight such as manufactured and retail goods carried by trucks—declined 1% in March 2024 compared with the same month in 2023, the 13th consecutive month of year-over-year declines.

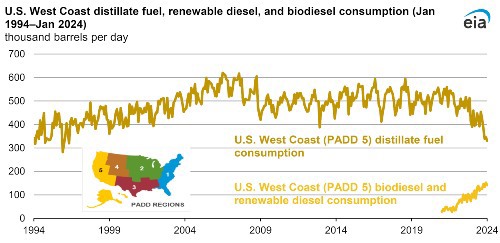

On the West Coast, continued substitution of biofuels (particularly renewable diesel) for petroleum distillate is reducing consumption of petroleum-based distillate fuel in that region. Renewable diesel and biodiesel are biofuels that can be used in place of petroleum distillate fuel oil. Unlike conventional biodiesel, renewable diesel is chemically identical to petroleum diesel and can be blended as a drop-in replacement fuel. Renewable diesel has a growing share of the region’s diesel fuel market because clean-fuel programs that began in 2011 provide incentives for its consumption.

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

We recently started publishing the product supplied of U.S. renewable diesel and biodiesel separately, and we have published data for combined renewable diesel and biodiesel dating back to 2021. In January 2024, consumption of combined renewable diesel and biodiesel on the West Coast averaged 141,000 barrels per day (b/d), near its all-time high of 152,000 b/d set in December 2023. In contrast, West Coast consumption of petroleum distillate fuel averaged 330,000 b/d in January, the least for any month since May 1996.

Renewable diesel consumption represents only about 4% of combined U.S. petroleum and biofuel distillate consumption, but we forecast consumption will continue growing this year and next. We expect this growth will continue to displace petroleum distillate fuel.

Related News

- Honeywell collaborates with SAF One and Tata Projects to enable sustainable aviation fuel production

- CF Industries, POET launch low-carbon fertilizer pilot to cut ethanol production carbon intensity

- ADNOC and TAQA announce 27-yr utilities agreement with TA’ZIZ, enabling world-scale chemicals production at Ruwais

Comments