Impact of gasoline and diesel outlook on US refiners

By ALAN GELDER, Wood Mackenzie

Globally, the US refining system is one of the most competitive

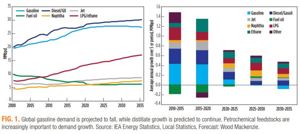

This strong performance has been delivered on a sustainable basis over recent years, as US refiners have typically enjoyed both advantaged crude and product pricing relative to their international peers. The global economic outlook remains positive, but the combined impact of improving vehicle fuel efficiencies and a growing penetration of electric vehicles (EVs) decouples oil demand growth from the economy. Initially, demand declines in the US and Europe have been countered by growth in the developing world, but our outlook for gasoline is ultimately one of global decline. Our conservative view of battery technology improvement results in electrification being focused on the passenger car segment. Therefore, a rise in distillate demand for road trucking is seen as economies grow, requiring more manufacturing and movement of goods. This difference in growth trajectories skews the refining system toward being distillate-led, rather than

The change in US demand outlook is more pronounced and potentially more challenging than the global changes. The projected gasoline demand decline of more than 100 Mbpd per year from 2020 onwards exceeds the opportunity for greater imports from Latin America. This will require the US refining system to extend its geographical reach beyond the Americas to maintain high utilization and profitability. However, these efforts will face increasing headwinds, as Wood Mackenzie’s global outlook suggests that the refining environment for Atlantic Basin assets becomes more challenging post-2023. In this timeframe, a strong risk of over-investment in refining capacity in the Middle East and Asia is considered, as the region needs to add, over the next 20 years, half of the capacity that it has added in the past 20 years.

Given that new investments tend to be

These are precedents that the US refining sector must consider in its strategic planning for the future. Alan Gelder will be leading a session exploring the market issues, opportunities and outlook for US refiners on Tuesday, March 13 during the 2 p.m.–5 p.m. session titled, “Global gasoline and diesel outlook, and its implications for US refiners.”

Comments