EIA: State taxes on gasoline in 2017 up 4.5% from 2016

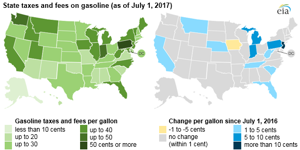

In EIA’s latest update of state gasoline and diesel fuel taxes data, the simple average of taxes and fees on gasoline levied by the states and the District of Columbia in effect as of July 1, 2017, was 27.9 cents per gallon (cents/gal), up 4.5% from the same time last year. These taxes and fees range from a low of 8.95 cents/gal in Alaska to a high of 59.3 cents/gal in Pennsylvania. Gasoline buyers in the United States pay these taxes at the pump in addition to the federal tax of 18.4 cents/gal, which has remained unchanged since 1993.

State taxes on diesel tend to be somewhat higher—averaging 28.6 cents/gal and ranging from 8.95 cents/gal in Alaska to 75.8 cents/gal in Pennsylvania. The federal tax on diesel of 24.4 cents/gal is slightly higher than the federal tax on gasoline.

Since July 1, 2016, New Jersey had the highest increases in their state excise taxes for gasoline and diesel fuel, which were up by 23 cents/gal and 27 cents/gal, respectively. Over the same period, Iowa reduced its gasoline and diesel taxes and fees by 1.2 cents/gal and 1.0 cents/gal, respectively, and California reduced its diesel taxes by 4.5 cents/gal.

A variety of taxes and fees are levied on motor fuels by all levels of government in the United States. Although these charges often include relatively small fees that provide revenue for environmental protection and other dedicated funds, governments use the largest portion of fuel tax revenues to build and maintain transportation infrastructure, effectively making the taxes equivalent to road user fees.

Some states base tax rate changes on average historical prices for fuel sold within the state. For instance, Pennsylvania computes the portion of its tax called the Oil Company Franchise Tax on the average wholesale price per gallon of each type of fuel.

Other states also apply sales taxes to motor fuels used on-highway. These taxes can represent a significant portion of the final selling price of fuel to consumers. Indiana's Gasoline Use Tax, computed on a monthly basis, was 12.8 cents/gal as of July 1. A 7% sales tax applies at the pump to retail, on-highway diesel prices before federal and state excise taxes are applied.

In EIA’s Short-Term Energy Outlook (STEO), these changes in state tax rates are reflected in the differences between the US wholesale average gasoline price and the retail gasoline prices, which include all federal and state taxes, across different Petroleum Administration for Defense Districts (PADDs).

Most of the tax increases over the past year occurred in states in the Northeast (PADD 1) and Midwest (PADD 2). Through the first half of 2017, the spread between retail prices for regular gasoline in the Northeast and the US average wholesale gasoline price averaged 68 cents/gal, 3 cents/gal higher than in the same period in 2016, following tax increases in New Jersey and Pennsylvania. Price spreads between regular retail gasoline and regular wholesale gasoline in the Midwest increased by about 2 cents/gal over the same period to reach an average of 61cents/gal, following tax increases in Michigan.

In addition to already existing tax changes at the time of publication, the STEO also accounts for future approved tax increases, such as California’s planned 12 cents/gal increase set to begin on Nov. 1. California represents a major portion of West Coast (PADD 5) gasoline consumption, so changes in California’s fuel taxes are expected to contribute to larger differences between West Coast retail and US average wholesale gasoline prices in the STEO forecast.

Comments