EIA: US crude oil exports went to more destinations in 2016

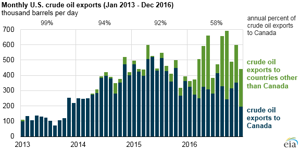

In 2016, US crude oil exports averaged 520,000 bpd, 55,000 bpd (12%) above the 2015 level, despite a year-over-year decline in domestic crude oil production. Even though oil exports have increased, growth in US crude oil exports has slowed significantly from its pace from 2013 to 2015, when annual US crude oil production grew rapidly.

Following the removal of restrictions on US crude oil exports in December 2015, the United States exported crude oil to 26 different countries in 2016, compared with 10 countries the previous year. In 2015, 92% of US crude oil exports went to Canada, which was exempt from US crude oil export restrictions. After restrictions were lifted, Canada remained the top destination but received only 58% of US crude exports in 2016.

Aside from Canada, European destinations such as the Netherlands, Italy, United Kingdom, and France rank high on the list of US crude oil export destinations. The second-largest regional destination is Asia, including China, Korea, Singapore, and Japan. In 2016, the United States exported to eight different Central and South American destinations, including Curacao, Colombia, and Peru.

Some nations listed as receiving crude oil exports from the United States in EIA export statistics, such as the Marshall Islands, Bahamas, Panama, and Liberia, are unlikely to be actual final destinations. Ports in the United States are not deep or wide enough to allow safe navigation and loading of the largest and most economic ships such as Very Large Crude Carriers to transport crude oil. Instead, US crude oil is exported on smaller vessels and is then transferred to larger vessels in deeper waters outside of port.

The US Customs and Border Protection documentation requires the final destination of an export to be listed, if known. In some cases, cargoes that undergo ship-to-ship transfer or that do not have a buyer prior to loading will cite the jurisdiction of the transfer or the registration flag of the vessel to which the cargo is being transferred, not the cargo's actual final destination. Many vessels are registered in nations such as the Marshall Islands, Bahamas, Liberia, and Panama—meaning the exported crude oil was likely destined elsewhere.

Curacao, located in the Caribbean Sea north of Venezuela, received 30,000 bpd of US crude oil in 2016, making it the third-largest destination. Petróleos de Venezuela (PDVSA), the state-owned oil company of Venezuela, operates the 330,000 bpd Isla refinery on Curacao, as well as crude and petroleum product storage facilities on the island. Trade press reports and tracking of ship movements indicate that US crude exports to Curacao are likely being blended with heavy Venezuelan crude oil, either for processing at the Isla refinery or for re-export to PDVSA customers.

Several factors appear to have contributed to the rise in US crude oil exports in 2016. Increased crude oil imports in 2016 substituted for some domestic crude oil at US refineries, allowing higher exports despite lower US production and increased refinery runs. Low tanker rates for most of 2016 helped to narrow the price spread needed to allow for an economically attractive trade between the United States and overseas markets. With the average daily volume of crude imports more than 12 times the average daily volume of crude exports, many tankers were available for back-haul voyages at rates significantly below regular tanker rates, likely further reducing the cost of reaching export markets.

Comments