EIA: Crude price differentials a factor as refining profits converge

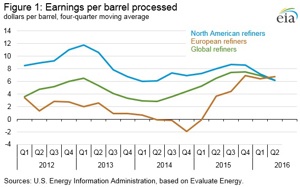

The US Energy Information Administration noted that refinery earnings were lower in Q2 2016 compared with the same time last year and are converging among different locations globally. Lower crack spreads (the price difference between crude oil and petroleum products) contributed to declining profits for some refiners compared with 2015. Also, North American refiners—which for years were consistently more profitable than other refiners—were less profitable than European refiners for the second consecutive quarter. Changes in North American and European crude oil price differentials are likely contributing to the convergence in profits.

Recently released Q2 statements from 27 companies show that 21 experienced a year-over-year decline in 2016 in refining profits, as measured by earnings per barrel processed. The decline in earnings was commensurate with the decline in crack spreads in Q2. In addition to changes in crack spreads, which serve as an indicator of refinery profits, earnings per barrel account for other costs, such as transportation costs and other operating expenses. Also, each refiner uses different crude oil blends and produces different yields of refined products, which will show differences among refiners in their per barrel earnings.

Analyzing the group of companies by primary refining region shows refinery earnings converging over the past year. The group of North American refiners consist of 14 companies with operations mainly in the US and Canada, while seven companies constitute the European group and six the Global group, so-named because its companies’ operations are geographically diversified and affected by crude oil and petroleum product prices in many regions of the world. Companies in North America and Europe, on the other hand, may be more subject to differences in local markets.

One factor contributing to a convergence in refinery profits is an increase in the US average refiner crude oil acquisition cost compared with global refiner acquisitions costs. Because crude oil and petroleum product prices are the two largest factors that affect a refiner’s profits, changes in the cost of crude oil acquisition can have a significant effect on profitability. North American refiners enjoyed a large discount to global crude oil prices for several years, measured by the difference between the US composite refiner acquisition cost and North Sea Brent crude oil prices. With price discounts often in the double digits, North American refiners were consistently more profitable than global and European refiners, which on average paid higher prices for crude oil. Since the Q3 of 2015, the discount has not widened beyond $4.50/bbl, reducing some US refiners’ competitive advantage on costs.

Many of the factors that contributed to the wide spread were driven by rapid increases in US and Canadian crude oil production that were not met with increases in infrastructure to allow the oil to be moved to refining centers inexpensively. Crude oil producers typically received a price lower than global prices for similar quality crude oils, giving some US refiners a cost advantage. These factors began to reverse in 2014 and 2015. New pipeline infrastructure increased takeaway capacity to refining areas, such as the BridgeTex and Cactus pipelines in West Texas and Flanagan South in the Midwest. US crude oil production declines, which began on a year-over-year basis in December 2015, also contributed to a comparatively tighter crude oil market in North America.

In the European market, refiners may be achieving increased efficiency through consolidating operations. The European companies in this analysis reduced distillation capacity 248 Mbpd in 2015, the fourth consecutive year of reductions. In addition, the crude oil market in Europe is comparatively looser than in North America, as Russian, Iranian, and Iraqi crude oil production has increased. Some refiners may be receiving lower costs for crude oil than other refiners as oil producers compete to maintain market share, which increases refinery profits. For example, the discount of Mediterranean Urals—a Russian crude oil many inland European refiners process—averaged greater than $2.00/bbl for most of 2016, which may have contributed to higher profits in recent quarters.

Crack spreads are lower in the Q3 and if the smaller spreads continue, it suggests Q3 refinery profits will be lower globally. Absent meaningful changes in geographic crude oil and petroleum product price differentials, however, refinery profits will likely display smaller variability across different locations.

Comments