Column: Valero blames excess winter production for US gasoline glut

(John Kemp is a Reuters market analyst. The views expressed are his own)

(Reuters) The accumulation of gasoline stocks in the US has been driven by excess gasoline production rather than lack of demand, according to Valero, the largest independent refiner in the US.

"A lot of it is really more a result of utilization, especially utilization in periods where we typically see refineries cut," the company noted during its second quarter earnings call on Tuesday.

"Typically we see refineries cutting in Q4 and Q1, and this year we saw refineries running very high utilization rates" due to the steep contango in the gasoline futures market.

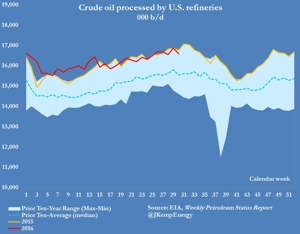

Valero's comments corroborate data from the US Energy Information Administration showing refineries running at record rates between November and March.

Consumption of gasoline and distillate in the domestic and export markets "remain robust" executives told analysts.

The company exported record volumes of gasoline and distillate fuel combined in the second quarter, particularly to Latin America, but gasoline sales at home also showed strong growth.

RUNNING IN WINTER

Valero executives were quizzed by analysts on whether demand had been overstated or whether the problem was on the supply side.

Valero chief Joseph Gorder responded: "our gasoline volumes through the wholesale are up 3%, and even on the distillate side, we're moving about 1% more through the wholesale channel of diesel than we did last year."

"We've seen very strong product demand", the company's head of supply and operations explained, but "refinery utilization has been such that we have been able to keep up and even outpace demand."

"With the steep contango in the market, especially early in the year, some marginal refining capacity that typically you would see cut in the winter had incentive to go ahead and run and produce summer grade gasoline".

Very high rates of refinery utilization, especially in January and February, resulted in an overhang of refined products that has persisted through the middle of the year.

The steep contango in futures prices at the start of the year encouraged refiners to produce summer-grade gasoline and send it into storage.

MAXIMISING GASOLINE

The big premium for gasoline over middle distillates also encouraged refiners to shift their refining operations to produce as much gasoline as possible and reduce production of heating oil, diesel and jet fuel.

"We've been in a strong maximum gasoline signal for the most part up until about a month ago," the company's head of engineering explained, "so our assets we just had them pointed to make as much gasoline as possible".

The company foresees the need for some run cuts by the refining industry during the third and fourth quarter to rebalance the market though it would not be drawn on its own plans.

But the company did note that it had switched from maximizing gasoline production to maximizing the output of jet fuel by changing the cut points in its distillation process.

ECONOMIC RUN CUTS

The company denied it would use the forthcoming maintenance period to implement additional cuts in refinery throughput though it noted that other refiners might try to do so.

"We have a strategy of planning our turnarounds a couple of years in advance ... We have a big system and we don't try to move our turnarounds based on what prompt economics are. (But) in the rest of the industry there may be some of that," the company's engineering chief observed.

"I'm sure that people are looking at whether the refineries are struggling from a maintenance perspective and they may bring maintenance forward" and fix systems early as an effective economic run cut, he added.

EAST COAST IMPORTS

Valero executives were also asked why the US was still importing so much gasoline, especially to the East Coast, where the build-up of stockpiles has also been highest.

The continued importation of so much gasoline, as well as crude oil, at a time when domestic oil producers and refiners are struggling, has become politically controversial.

Valero explained its big refineries along the US Gulf Coast have a "competitive advantage" exporting to Mexico and South America rather than moving gasoline to US Northeast because of the Jones Act shipping restrictions.

Shipping gasoline from the Gulf Coast to the US Northeast is more expensive because the law requires Valero to use US flagged and built vessels with US officers and crews.

"The natural flow of our barrels is to south into South America and there's been an incentive to send barrels from Northwest Europe into New York Harbor."

By John Kemp; Editing by William Hardy

Comments