US gasoline oversupply pushes crude oil prices lower

(Reuters) US gasoline stocks remain stubbornly high despite record demand from motorists, a situation that will probably force refiners to cut crude processing over the next few months and prioritize production of diesel.

The prospect of reduced refinery processing rates has intensified the downward pressure on crude oil prices in recent days.

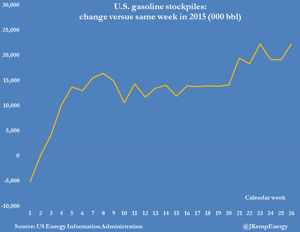

US gasoline stockpiles have been running above last year's level since January but the year-on-year build-up has increased rather than lessened as the summer driving season arrived.

Gasoline stockpiles hit a seasonal record 239 MMbbl on June 24, an increase of 22 MMbbl (10%) compared with the previous year, according to data from the US Energy Information Administration.

The year-on-year stock build has grown from 14 MMbbl (6%) at the end of April and 10 MMbbl (4%) in late January (see chart above).

The gain in stockpiles has been most pronounced along the US East Coast, where stocks were 13 MMbbl (21%) higher than prior-year levels and still increasing as recently as June 24.

The degree of oversupply is less in other parts of the eastern US.

Gasoline stocks in the Midwest are up by 4 MMbbl (8%), while stocks on the Gulf Coast are up by 6 MMbbl (8%).

But the East Coast is the pricing point for US gasoline futures which call for delivery to New York Harbor.

Tankers have been forced to anchor off the harbor, unable to discharge their cargo, because local tanks are full.

Unsurprisingly, gasoline futures prices and crack spreads have come under pressure as stocks build in the region.

The crack for gasoline delivered in October has fallen from a peak of almost $0.30 per gallon on May 23 to less than $0.22 on July 5.

Futures prices are anticipating even worse oversupply once the peak demand season for gasoline finishes in September.

In contrast to gasoline futures, crack spreads for middle distillates such as heating oil and diesel, have continued to climb.

Refiners have only limited flexibility to shift from producing gasoline to distillates in the short term.

So the main response to falling gasoline cracks is likely to come through reduced refinery crude processing, which will cut the output of heating oil as well as gasoline.

Delta's refinery at Philadelphia has already cut production by 16%, according to sources familiar with the plant's operations.

Run cuts should eventually rebalance the gasoline market but will tighten the distillate market even further, supporting heating oil cracks.

By John Kemp; Editing by Dale Hudson

Comments