McKinsey Energy forecasts LNG oversupply until 2024

London, UK - McKinsey Energy Insights' (MEI) latest forecast predicts LNG oversupply could last until 2024. As a result, this could mean that few LNG projects will reach final investment decision (FID) in the next 12 to 18 months.

MEI’s research shows that the current global LNG supply glut is exacerbated by the 100 MMtpy of new export terminal capacity presently under construction in the US and Australia. By 2019, the global LNG oversupply will peak at 60 MMtpy.

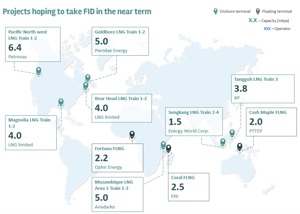

MEI has modeled 10 upcoming LNG projects at FID stage – including Coral FLNG and Mozambique LNG – against its Energy Insights LNG cost curve. James Walker, specialist at MEI says, “Our research shows that the current market oversupply is creating challenging conditions for operators hoping to take FID on projects in the near term. For these projects to be viable, they would require an assumption of either a sustained high LNG price post-2024 or a cost optimization strategy to reduce projected capital expenditures.

“Many projects will struggle to secure enough firm buyers in an oversupplied market. Even if projects do manage to progress to construction, the LNG supply will be hitting the market at a bad time.”

The research highlights that the market will remain oversupplied unless today’s low prices can stimulate a demand recovery. However, to date, the demand response to the low LNG prices seen in the past two years has been limited.

The research was modeled using MEI’s Global Gas Model software which provides clients with McKinsey’s global reach and local insights to develop their own view of the future.

Comments