EIA: China diesel exports grow as refining industry, economy change

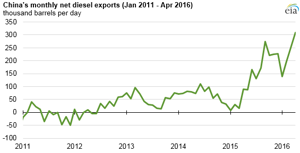

According to data provided by the US Energy Information Administration (EIA), a structural shift in the Chinese economy and reforms in its refining sector have driven exports of diesel to increase rapidly since 2015. An accompanying reduction in demand has pushed net diesel exports to more than 300 Mbpd in April of this year.

Slow demand growth, high inventories due to reduced US and European winter heating consumption, and new or expanded Middle East refinery capacity designed to maximize diesel production have contributed to low global diesel market prices.

China’s emergence as a growing net exporter of diesel, which is particularly relevant to the Asia-Pacific market, is contributing to the growing oversupply in global diesel markets. The country has been an important driver of diesel demand growth over the past several decades but is now a net diesel exporter.

China's economy is gradually shifting from heavy manufacturing to commercial services and personal domestic consumption. So, demand for gasoline and jet fuel has grown more than the demand for diesel. Chinese refineries, which tend to have high diesel yields, have increased refinery runs to meet demand for gasoline. Slower demand growth for diesel combined with increased coproduction of diesel has resulted in high inventories and increased supply, the EIA said.

China's refining capacity is dominated by state-owned PetroChina and Sinopec, which account for a combined 72% of the country’s total refining capacity. The remaining refining capacity is controlled by independent regional companies, commonly known as teapots or teakettles.

China began granting crude oil import licenses to some of these teapot refineries to increase domestic fuel market competition. Previously, independent refiners imported and processed mainly heavy fuel oil, a lower-quality feedstock compared to crude oil, and had limited access to some domestically produced crudes.

Refining the higher-quality crude oil allows the independent refineries to produce a slate of higher-value products, such as gasoline and jet fuel. This is increasing the competition with the larger, state-owned refineries and decreasing their market share in regions with independent refineries. The supplies of diesel produced at these larger refineries that used to be delivered to the teapot refineries must now find alternative markets through exports.

Comments